Email

1001@tiandot.com

Email

1001@tiandot.com

Sea freight is the backbone of global trade, moving goods across oceans. It offers a cost-effective and reliable means of transportation for large shipments.

Sea freight, or ocean freight, involves shipping goods by sea. This method is used for large and heavy shipments, transported in containers on cargo ships.

Sea freight is vital, handling over 90% of global trade by volume. It provides economies of scale and is essential for industries like automotive, electronics, and apparel. For example, China, the world’s largest exporter, relies on sea freight to support global supply chains and economic growth.

Sea freight from China is highly cost-effective. It offers competitive rates compared to air freight, making it ideal for businesses looking to reduce shipping costs. For example, shipping a 40ft container from China to the US can be up to 75% cheaper than air freight.

China’s sea freight can handle large shipments efficiently. With high-capacity cargo ships, it is possible to transport bulk goods without incurring significant costs. This is particularly beneficial for industries like manufacturing and retail, where large quantities of goods are moved regularly.

China boasts some of the world’s most accessible ports. Ports like Shanghai, Shenzhen, and Ningbo-Zhoushan are equipped with advanced infrastructure and technology, ensuring smooth operations and reducing delays. These ports are strategically located to connect with global shipping routes, enhancing trade efficiency.

China is a global leader in exports, producing a wide range of goods from electronics and machinery to textiles and furniture. In 2022, China’s export volume reached over $3 trillion, highlighting its pivotal role in the global economy.

China’s leading ports, such as the Port of Shanghai (the world’s busiest container port), play a crucial role in global trade. These ports handle millions of TEUs (twenty-foot equivalent units) annually, facilitating the efficient movement of goods worldwide. The strategic significance of these ports ensures that businesses can rely on timely and efficient shipping services.

The Port of Shanghai is the world’s busiest container port, handling over 42 million TEUs annually. It offers advanced infrastructure and seamless connectivity to global shipping routes, making it a key hub for international trade.

The Port of Shenzhen is another major player, managing over 27 million TEUs each year. It is known for its efficient operations and proximity to major manufacturing zones, ensuring quick turnaround times for shipments.

The Port of Ningbo-Zhoushan ranks among the top ports globally, with a throughput of over 29 million TEUs. It combines state-of-the-art facilities with excellent logistics services, providing robust support for exporters and importers.

The Port of Guangzhou handles approximately 23 million TEUs annually. It features comprehensive warehousing and distribution centers, making it an essential port for China’s trade with Southeast Asia and beyond.

The Port of Qingdao is a major hub in northern China, processing over 22 million TEUs each year. It boasts advanced technology and efficient handling, supporting the export of goods such as electronics and textiles.

The Port of Tianjin is a key gateway to Beijing and northern China, with an annual capacity of over 18 million TEUs. Its strategic location and robust facilities make it critical for both domestic and international trade.

The Port of Hong Kong remains one of the busiest and most efficient ports, handling around 18 million TEUs annually. Its deep natural harbor and extensive connectivity support a wide range of global trade activities.

China’s major ports are equipped with high-capacity cranes and automated systems that can handle millions of containers efficiently. This capability ensures smooth loading and unloading, reducing dwell time for ships.

Ports like Shanghai and Shenzhen offer extensive warehousing and storage facilities. These include temperature-controlled warehouses and bulk storage options, ensuring goods are stored safely and securely until they are ready for shipment.

Major Chinese ports are well-connected to inland transportation networks, including railways and highways. This connectivity allows for the swift movement of goods from the port to their final destinations, enhancing the overall efficiency of the supply chain. For example, the Port of Ningbo-Zhoushan is linked to over 20 rail lines, facilitating rapid inland distribution.

| Port | Annual TEU Capacity | Key Features |

|---|---|---|

| Port of Shanghai | 42 million | World’s busiest container port, advanced infrastructure |

| Port of Shenzhen | 27 million | Proximity to manufacturing zones, efficient operations |

| Port of Ningbo-Zhoushan | 29 million | State-of-the-art facilities, excellent logistics services |

| Port of Guangzhou | 23 million | Comprehensive warehousing, key for Southeast Asia trade |

| Port of Qingdao | 22 million | Advanced technology, supports electronics and textiles export |

| Port of Tianjin | 18 million | Strategic location near Beijing, robust facilities |

| Port of Hong Kong | 18 million | Deep natural harbor, extensive connectivity |

Booking a shipment is the first step in the sea freight process. Choose a reliable freight forwarder by comparing quotes and services. Provide detailed information about your shipment, including type of goods, volume, and destination. In 2022, over 23 million TEUs were exported from China’s major ports, emphasizing the need for efficient booking.

Proper packaging and labeling are crucial for safety and compliance. Use durable materials to protect goods. Each package must be labeled with the destination address, handling instructions, and any hazardous material warnings. According to industry standards, correct labeling reduces shipping delays by 20%.

Customs clearance involves preparing and submitting essential documents like the commercial invoice, packing list, and bill of lading. Inaccurate documentation can cause delays, costing companies an average of $500 per day. Collaborate with your freight forwarder to meet all regulatory requirements and ensure smooth processing.

After customs clearance, goods are loaded onto cargo ships using cranes and other equipment. This stage must be handled with precision to prevent damage. China’s ports, like the Port of Shanghai, handle over 42 million TEUs annually, highlighting the importance of efficient loading practices. The ship then transports goods to the destination, adhering to the scheduled transit time.

At the destination port, goods are unloaded and undergo customs clearance. The freight forwarder manages the logistics of moving goods from the port to the final delivery point, using trucking or rail transport. Ensure all documentation is complete to facilitate a smooth delivery process. Efficient unloading and delivery are crucial, as delays can impact overall supply chain efficiency.

FCL, or Full Container Load, involves the shipment of goods that fill an entire container. This method is ideal for businesses with large volumes of cargo. Benefits include lower cost per unit, reduced risk of damage, and faster transit times. For instance, an electronics company shipping 1000 laptops would find FCL more cost-effective and secure than other methods.

LCL, or Less than Container Load, is perfect for shipments that do not fill a full container. This service allows multiple shippers to share container space, making it cost-effective for smaller shipments. Benefits include lower upfront costs and flexibility. For example, a small business exporting 50 boxes of clothing can save money by opting for LCL instead of FCL.

RORO, or Roll-on/Roll-off, is used for shipping vehicles and large machinery. Goods are driven onto the vessel and secured for transit. This method is efficient for automobiles, trucks, and heavy equipment. Benefits include ease of loading/unloading and cost efficiency. A construction company exporting bulldozers would benefit from using RORO due to the simplicity of the loading process.

Bulk shipping is designed for transporting large quantities of unpackaged goods, such as grains, coal, and ore. This method uses specialized vessels to carry goods in bulk form. Benefits include high-volume capacity and cost efficiency for massive shipments. For example, an agricultural exporter shipping 50,000 tons of wheat would use bulk shipping to take advantage of its capacity and lower cost per ton.

| Service Type | Benefits | Scenarios for Use |

|---|---|---|

| FCL (Full Container Load) | Lower cost per unit, reduced risk, faster transit | Large volumes, e.g., 1000 laptops by an electronics company |

| LCL (Less than Container Load) | Lower upfront costs, flexibility | Smaller shipments, e.g., 50 boxes of clothing by a small business |

| RORO (Roll-on/Roll-off) | Ease of loading/unloading, cost efficiency | Vehicles and machinery, e.g., bulldozers by a construction company |

| Bulk Shipping | High-volume capacity, cost efficiency | Unpackaged goods, e.g., 50,000 tons of wheat by an agricultural exporter |

Shipping rates are a major component of sea freight costs. These rates depend on the container size (20ft or 40ft) and the distance between the origin and destination ports. For example, shipping a 40ft container from Shanghai to Los Angeles can cost between $2,000 to $3,000 depending on market conditions.

Customs duties and taxes are levied by the destination country. These costs vary based on the type of goods and their declared value. For instance, importing electronics into the US incurs a duty of around 5-10% of the shipment value.

Insurance protects your goods against loss or damage during transit. The cost of insurance is typically around 0.3% to 0.5% of the cargo’s value. For high-value items, such as electronics or machinery, investing in insurance is crucial to mitigate risks.

Handling and logistics fees cover the costs of loading, unloading, and transporting goods within ports. These fees can range from $300 to $500 per container and include services like terminal handling charges and documentation fees.

The weight and volume of your shipment significantly impact costs. Heavier and bulkier shipments incur higher fees. For example, a shipment of industrial machinery will cost more than a container of textiles due to its weight and size.

Different ports have varying fee structures. Destination port fees can include charges for customs clearance, storage, and delivery. Ports with higher traffic, like Los Angeles, might have higher fees compared to smaller ports.

Shipping costs can fluctuate based on seasonal demand. During peak seasons, like the holiday period or Chinese New Year, rates can increase by 20-30% due to higher demand for shipping services.

Consolidating smaller shipments into one full container load (FCL) can save costs. This reduces the per-unit shipping rate and minimizes handling fees. For example, combining shipments from multiple suppliers into one container can lead to significant savings.

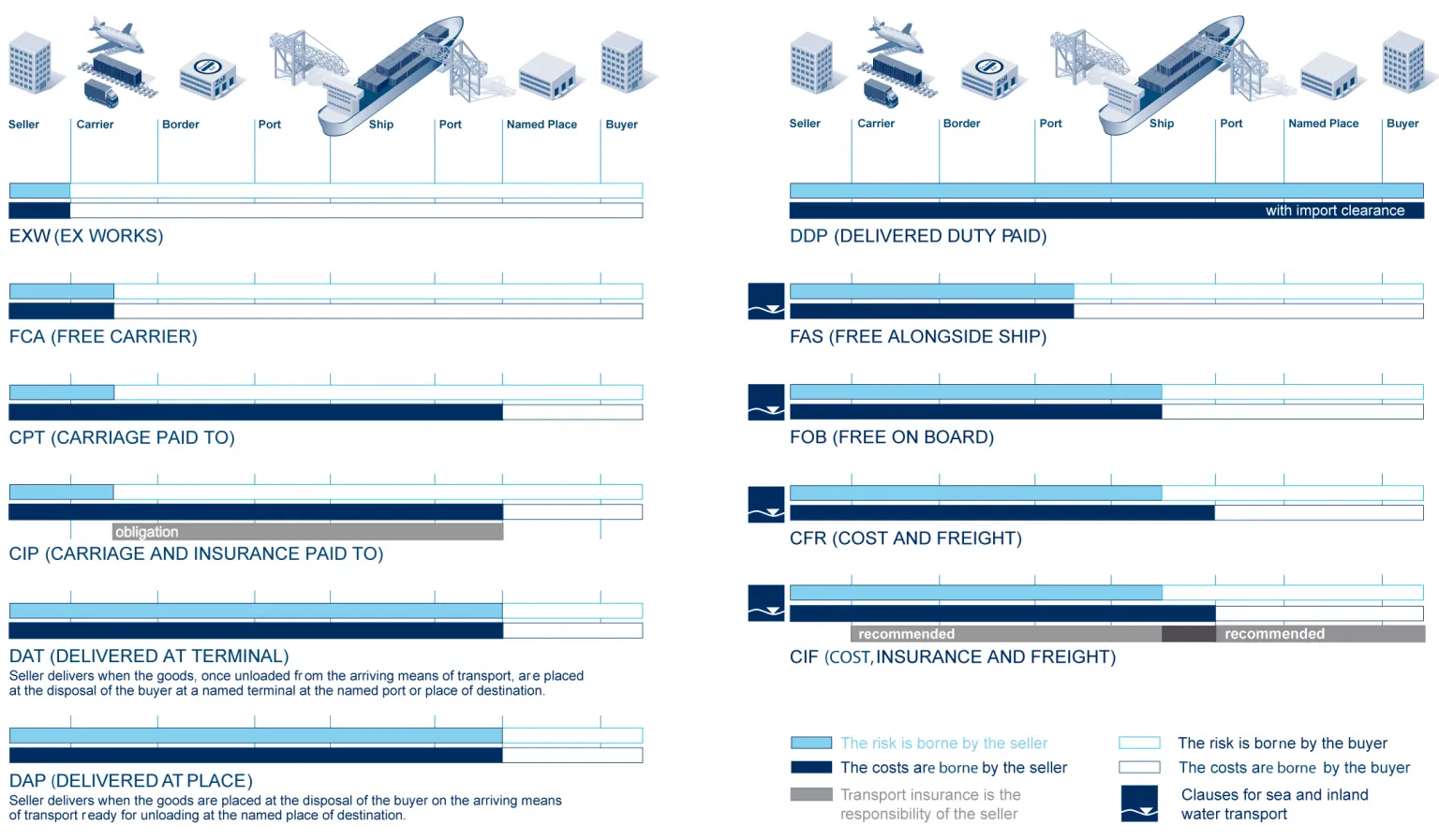

Selecting the appropriate Incoterm can impact overall costs. Incoterms like FOB (Free on Board) or EXW (Ex Works) clearly define the cost responsibilities between the buyer and seller, helping avoid unexpected expenses.

Negotiating rates with multiple freight forwarders can lead to better deals. Establishing a long-term relationship with a reliable forwarder can also result in discounts and preferential rates. For instance, securing a contract for regular shipments can reduce per-shipment costs by up to 15%.

| Cost Component | Details |

|---|---|

| Shipping Rates | $2,000 – $3,000 for a 40ft container from China to the US |

| Customs Duties and Taxes | 5-10% of shipment value for electronics in the US |

| Insurance | 0.3% – 0.5% of cargo value |

| Handling and Logistics Fees | $300 – $500 per container |

| Factors Influencing Costs | Weight, volume, destination port fees, seasonal variations |

| Cost-Saving Tips | Consolidating shipments, choosing the right Incoterm, negotiating rates |

The distance between the origin and destination ports is a primary factor influencing transit times. Longer distances naturally result in longer shipping times. For example, shipping from China to the west coast of the United States typically takes around 14 to 20 days, while shipping to Europe might take 30 to 40 days.

The shipping route taken by the vessel can also affect transit times. Routes passing through busy waterways or requiring stops at multiple ports may take longer. For instance, a route from China to Europe through the Suez Canal is faster than one circumventing Africa but may face delays due to traffic in the canal.

Port congestion can significantly delay shipments. Busy ports like those in Shanghai or Los Angeles often experience congestion, adding days to the transit time. Additionally, the customs clearance process at the destination port can cause delays if documentation is incomplete or if there are inspections. Efficient clearance processes can save several days in transit time.

The average transit time for sea freight from China to North America varies based on the specific ports involved. Shipping to the west coast (e.g., Los Angeles or Seattle) generally takes 14 to 20 days. To the east coast (e.g., New York), it can take 25 to 35 days due to the longer distance and more complex shipping routes.

Transit times from China to Europe typically range from 30 to 40 days. Major European ports like Rotterdam or Hamburg receive frequent shipments from China. The route through the Suez Canal is the most direct and fastest, though delays in the canal can affect transit times.

Shipping from China to Africa and the Middle East has a wide range of transit times due to the varied distances and routes. For example, shipping to the Middle East (e.g., Dubai) takes approximately 20 to 25 days, while shipping to ports in West Africa can take 40 to 50 days. These times can be influenced by the chosen shipping route and any required stops along the way.

| Destination Region | Average Transit Time | Key Factors Impacting Time |

|---|---|---|

| North America (West Coast) | 14 to 20 days | Distance, port congestion, customs clearance |

| North America (East Coast) | 25 to 35 days | Longer distance, complex routes |

| Europe | 30 to 40 days | Route through Suez Canal, potential delays |

| Middle East | 20 to 25 days | Direct routes, efficient ports |

| Africa | 40 to 50 days | Long distances, multiple stops, port efficiency |

Standard containers are the backbone of sea freight, available in 20ft and 40ft sizes. The 20ft container can hold approximately 33 cubic meters of cargo, while the 40ft container can accommodate around 67 cubic meters. The 40ft High Cube container offers an additional foot of height, providing more space for bulky items, with a capacity of 76 cubic meters.

Specialized containers cater to specific shipping needs. Reefer containers are refrigerated and ideal for perishable goods like fruits, vegetables, and pharmaceuticals. Open Top containers allow for easy loading of oversized cargo, such as machinery. Flat Rack containers are used for heavy loads and irregularly shaped items that cannot fit in standard containers.

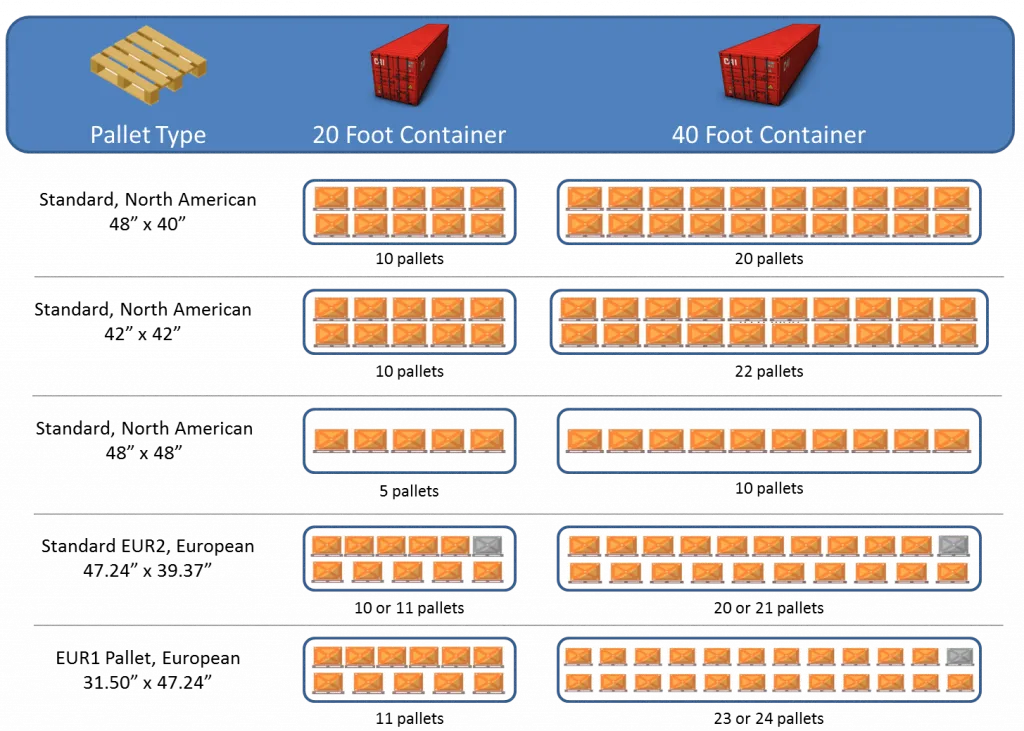

Pallets come in various sizes, with the standard size being 48 x 40 inches in the US, and 1200 x 1000 mm in Europe. Pallets can be made from wood, plastic, or metal, each offering different levels of durability and load capacity. For instance, wooden pallets are widely used due to their cost-effectiveness, while plastic pallets are preferred for hygiene-sensitive goods.

Proper packaging is crucial for protecting goods during transit. Cartons should be sturdy and sized to fit the pallets securely. Use cushioning materials to prevent damage, and ensure cartons are stacked evenly to maintain balance. Following ISPM 15 guidelines for wooden pallets is essential to avoid quarantine issues in international shipping.

Securing shipments involves using straps, shrink wrap, and corner protectors to stabilize the load. Clearly label each pallet and carton with the destination address, handling instructions, and barcodes for tracking. Proper labeling ensures smooth customs clearance and minimizes the risk of misplaced items. According to industry data, well-labeled shipments reduce handling errors by 30%.

| Container Type | Description | Use Case |

|---|---|---|

| 20ft Standard | 33 cubic meters capacity | General cargo |

| 40ft Standard | 67 cubic meters capacity | Large volume shipments |

| 40ft High Cube | 76 cubic meters capacity, extra height | Bulky items |

| Reefer | Refrigerated for perishable goods | Fruits, vegetables, pharmaceuticals |

| Open Top | Open top for oversized cargo | Machinery, heavy equipment |

| Flat Rack | Flat rack for heavy and irregular items | Construction materials, large machinery |

| Pallet Type | Description | Use Case |

|---|---|---|

| Wooden Pallet | Cost-effective, standard size | General cargo |

| Plastic Pallet | Hygienic, durable | Food and pharmaceuticals |

| Metal Pallet | Heavy-duty, high durability | Industrial goods, heavy loads |

Proper use of containers, pallets, and cartons ensures efficient, safe, and cost-effective sea freight shipping.

Incoterms (International Commercial Terms) are a set of standardized rules published by the International Chamber of Commerce (ICC). They define the responsibilities of buyers and sellers in international trade, particularly regarding the delivery of goods. Understanding Incoterms is crucial as they determine who bears the costs and risks at each stage of the shipping process, ensuring clarity and reducing disputes.

Under EXW (Ex Works), the seller’s responsibility ends when the goods are made available at their premises. The buyer bears all costs and risks involved in transporting the goods from the seller’s location to the destination. This term places the maximum obligation on the buyer and minimum obligations on the seller. It is often used when the buyer can handle the logistics and import process independently.

FOB (Free on Board) means the seller is responsible for delivering the goods onto a vessel chosen by the buyer. The risk transfers to the buyer once the goods are loaded on board. This term is beneficial for buyers who want more control over the shipping process. For instance, if you’re importing machinery from China, FOB allows you to manage your preferred shipping and insurance arrangements.

With CIF (Cost, Insurance, and Freight), the seller covers the cost of transporting the goods to the destination port, including insurance against loss or damage during transit. The risk transfers to the buyer once the goods are loaded onto the vessel. CIF is commonly used for sea freight because it provides a balanced approach where the seller handles shipping logistics and insurance, making it easier for the buyer.

DDP (Delivered Duty Paid) puts the maximum responsibility on the seller, who pays for all costs, including shipping, insurance, and import duties, to deliver the goods to the buyer’s location. The seller bears all risks until the goods are delivered. This term is advantageous for buyers who prefer a hassle-free shipping process, as the seller manages the entire logistics chain.

Choosing the right Incoterm is essential for managing risk and cost distribution effectively. Incoterms define who pays for shipping, insurance, and duties, and where the risk transfers from seller to buyer. For example, EXW places most of the responsibility on the buyer, while DDP places it on the seller.

Each Incoterm specifies the responsibilities of the buyer and seller. Understanding these responsibilities helps avoid misunderstandings and conflicts. For instance, under FOB, the seller must ensure the goods are safely loaded onto the vessel, while the buyer handles the insurance and transportation from that point. Choosing an Incoterm that aligns with your logistics capabilities and risk appetite can streamline the shipping process and reduce costs.

| Incoterm | Seller’s Responsibility | Buyer’s Responsibility | Risk Transfer Point |

|---|---|---|---|

| EXW | Make goods available at premises | All transportation, insurance, import duties | At the seller’s premises |

| FOB | Deliver goods on board vessel | Shipping, insurance from loading onward | Once goods are loaded on the vessel |

| CIF | Shipping to port, insurance | Import duties, further transportation | Once goods are loaded on the vessel |

| DDP | All costs, including duties | None until delivery | At the buyer’s specified destination |

Choosing the right Incoterm ensures a smooth and efficient shipping process, tailored to your specific needs and capabilities.

When selecting a sea freight forwarder, their experience and reputation are crucial. An experienced forwarder will have extensive knowledge of shipping routes, customs regulations, and logistics management. Look for companies with a proven track record and positive reviews from clients. For example, a forwarder with over 20 years of experience in handling shipments from China to Europe demonstrates reliability and expertise.

A strong network and solid partnerships with shipping lines, port authorities, and local agents are essential for efficient freight forwarding. A well-connected forwarder can offer better rates, faster transit times, and priority handling. For instance, a forwarder with partnerships with major shipping lines like Maersk or COSCO can secure better slots and rates for your shipments.

Excellent customer service and support are vital for a smooth shipping experience. Choose a forwarder that provides responsive communication, real-time tracking, and dedicated account managers. This ensures that any issues or questions are promptly addressed, minimizing delays and ensuring peace of mind. A forwarder with a 24/7 customer service team can be a significant advantage.

The Bill of Lading (B/L) is a crucial document in sea freight. It serves as a receipt for the shipped goods, a contract between the shipper and the carrier, and a document of title. This document details the type, quantity, and destination of the goods. It is essential for customs clearance and must be accurately filled out to avoid delays.

A Commercial Invoice is a key document that provides detailed information about the goods being shipped. It includes the seller’s and buyer’s information, description of goods, quantity, price, payment terms, and shipping details. This invoice is used by customs authorities to determine the duties and taxes payable, making accuracy crucial.

The Packing List is a detailed list of the contents of the shipment. It includes information on the number of packages, dimensions, weight, and description of each item. This document helps in the verification of goods during customs clearance and ensures that all items are accounted for during transit.

A Certificate of Origin certifies the country where the goods were manufactured. It is required by customs authorities to determine the tariffs and duties applicable to the shipment. This document is particularly important for goods subject to preferential duty rates under trade agreements.

Complying with import and export regulations is essential for smooth shipping. Each country has specific regulations that must be followed, including product standards, labeling requirements, and import licenses. Failing to comply can result in delays, fines, or even confiscation of goods.

Adhering to sanctions and trade restrictions is crucial to avoid legal issues. Countries may impose sanctions on certain goods, companies, or countries. It is important to stay updated on current sanctions and ensure that your shipment complies with all relevant restrictions. Violating these can lead to severe penalties and legal repercussions.

Understanding and preparing the necessary documentation and ensuring compliance with international trade regulations is vital for successful sea freight operations. These steps help in reducing delays, avoiding fines, and ensuring a smooth flow of goods through customs.

The shipping route from Asia to North America is a vital corridor for global trade. Major Chinese ports like Shanghai and Shenzhen connect with key ports on the US West Coast, such as Los Angeles and Seattle. In 2021, over 4 million TEUs were shipped from China to the US West Coast, highlighting the significant trade volume on this route. The Panama Canal is also a critical passage for shipments to the US East Coast.

The Asia to Europe route primarily uses the Suez Canal, linking Chinese ports to major European ports such as Rotterdam and Hamburg. This route is crucial for transporting a variety of goods, including electronics, textiles, and machinery. The efficiency of the Suez Canal, which sees over 50 vessels daily, is a significant factor in determining transit times and costs.

Shipping from Asia to Africa and the Middle East involves routes passing through the Indian Ocean and the Red Sea. Major destination ports include Dubai in the UAE and Durban in South Africa. This route supports the export of machinery, electronics, and textiles, with increasing trade volumes reflecting its growing importance. For example, the Port of Dubai handles over 14 million TEUs annually, with a significant portion coming from Asia.

Several factors influence transit times for sea freight:

| Route | Average Transit Time | Key Factors |

|---|---|---|

| Asia to North America | 14 to 35 days | Distance, Panama Canal, port congestion |

| Asia to Europe | 30 to 40 days | Suez Canal efficiency, direct routes |

| Asia to Africa and Middle East | 20 to 50 days | Distance, multiple stops, port efficiency |

Delays and disruptions are common in sea freight, often caused by weather conditions, labor strikes, and technical issues with vessels. For instance, typhoons in the Pacific can delay shipments by several days. In 2021, port closures due to COVID-19 outbreaks also caused significant disruptions, affecting global supply chains.

Port congestion is a major issue at busy Chinese ports like Shanghai and Shenzhen. High volumes of cargo and limited handling capacity can lead to bottlenecks and long wait times for vessels to dock and unload. This congestion can extend delivery times by several days or even weeks, impacting the entire logistics chain.

Frequent regulatory changes can complicate sea freight operations. Changes in customs regulations, tariffs, and import/export policies can affect shipping schedules and costs. For example, new environmental regulations on sulfur emissions from ships have increased operational costs for shipping companies, which can be passed on to the shippers.

Selecting the right shipping schedule can help mitigate delays. Shippers should plan shipments during off-peak times to avoid congestion. For example, avoiding the pre-Chinese New Year rush can result in faster processing and fewer delays. Using advanced planning tools can help identify the best times to ship goods.

Diversifying ports of entry can reduce reliance on congested ports and mitigate delays. Instead of shipping exclusively to high-traffic ports like Shanghai, consider using alternative ports such as Ningbo-Zhoushan or Tianjin. These ports often have shorter wait times and can provide more efficient handling of goods.

Keeping updated with trade news is crucial for anticipating and responding to changes in the shipping landscape. Subscribing to industry newsletters, joining trade associations, and following relevant news sources can provide timely information on regulatory changes, port conditions, and other factors affecting sea freight. This proactive approach allows shippers to adjust their strategies and minimize disruptions.

| Challenges | Solutions |

|---|---|

| Delays and Disruptions | Choose the right shipping schedule |

| Port Congestion | Diversify ports of entry |

| Regulatory Changes | Stay updated with trade news |

By understanding these common challenges and implementing effective solutions, businesses can navigate the complexities of sea freight from China more efficiently, ensuring timely and cost-effective delivery of goods.